CareerBuilder + Monster + Apollo: How to F**K an Industry in Less than a Year.

Happy Friday, Job Board Doctor friends.

Happy Friday, Job Board Doctor friends.

Another seven sunrises have passed since we last chatted, and this week brought yet another barrage of news in the job board and recruitment tech world.

As you might have guessed, we’re diving into the CareerBuilder + Monster bankruptcy filing — who’s owed money, what’s owed, how likely they are to see a dime of it, and what is coming next.

In our industry and tech in general, we talk a lot about private equity, venture capital, and holding companies like Apollo in broad strokes.

And while many of us know they’re (one of) the real monster at the end of the CareerBuilder + Monster story, it’s important not to lose sight of the real-world consequences this has for real people.

Chasing a headline or dancing on the grave of once-mighty platforms shouldn’t overshadow that.

The Timeline:

6/23 – Monster Begins Layoffs

The week kicked off with Monster slashing jobs in sales — including new business acquisition. Exact figures and terms aren’t confirmed, but word on the street is that impacted employees received just two weeks of severance, regardless of tenure.

There is going to be some incredibly talented folks hitting the market, well, now.

According to a LinkedIn post from longtime Monster employee Julie Deweese, (Major Accounts Manager) who worked for the company for nearly two decades, the separations were effective upon notification.

Another LinkedIn post this week that caught my eye was by Monster Senior Sales Director, Jason Flash.

A glance through the comments on Jason’s leadership seems pretty telling of the talent this organization is discarding.

If the opportunity arises, scooping them up seems smart.

6/24 – CareerBuilder + Monster File for Bankruptcy and announces asset purchase agreements

The bankruptcy includes a plan to sell off the collective assets of both CareerBuilder and Monster to at this point, three separate buyers.

CareerBuilder + Monster (the “Company”) today announced that it has initiated a court-supervised sale process to maximize value, preserve jobs and seamlessly transition ownership of its businesses. Specifically, the Company:

Entered into an asset purchase agreement with JobGet Inc. for the sale of the Company’s job board business, which provides a talent marketplace connecting employers with job candidates;

Entered into an asset purchase agreement with Valnet Inc. for the sale of Monster Media Properties, which is comprised of www.military.com and www.fastweb.com; and

Entered into an asset purchase agreement with Valsoft Corporation for the sale of Monster Government Services, which provides human capital management software services to state and federal governments.

The filing itself isn’t exactly a thrilling read — though for the legal-curious, like me, I’ve uploaded it here.

For the rest of you, here are the lowlights:

- Estimated Assets: $50–$100 million

- Estimated Liabilities: $100–$500 million

- Estimated Number of Creditors: 1,000–5,000

- Available Funds for Unsecured Creditors: None (after administrative expenses are paid)

That last line bears repeating: There will be no funds available for unsecured creditors.

6/25 – The IOUs Are In

Based on background conversations and the timeline I’ve pieced together, the market instability began not long after the CareerBuilder + Monster merger.

By Q3 2024, the whispers had started: vendors weren’t getting paid by an unnamed partner. Then, otherwise reliable programmatic partners started to be impacted, and 30-day payments were stretching to 45… then 90+ days.

Accounts receivable teams across the ecosystem have been chasing invoices ever since. CPCs started dropping, and what was still a flush job market suddenly became a vendor system in turmoil — at least for those of us who have a revenue stream based on programmatic monetization.

To their credit — and from all accounts — it appears Monster continued to act responsibly. The outstanding vendor debt showing up in the court filings, as I understand it, belongs to CareerBuilder.

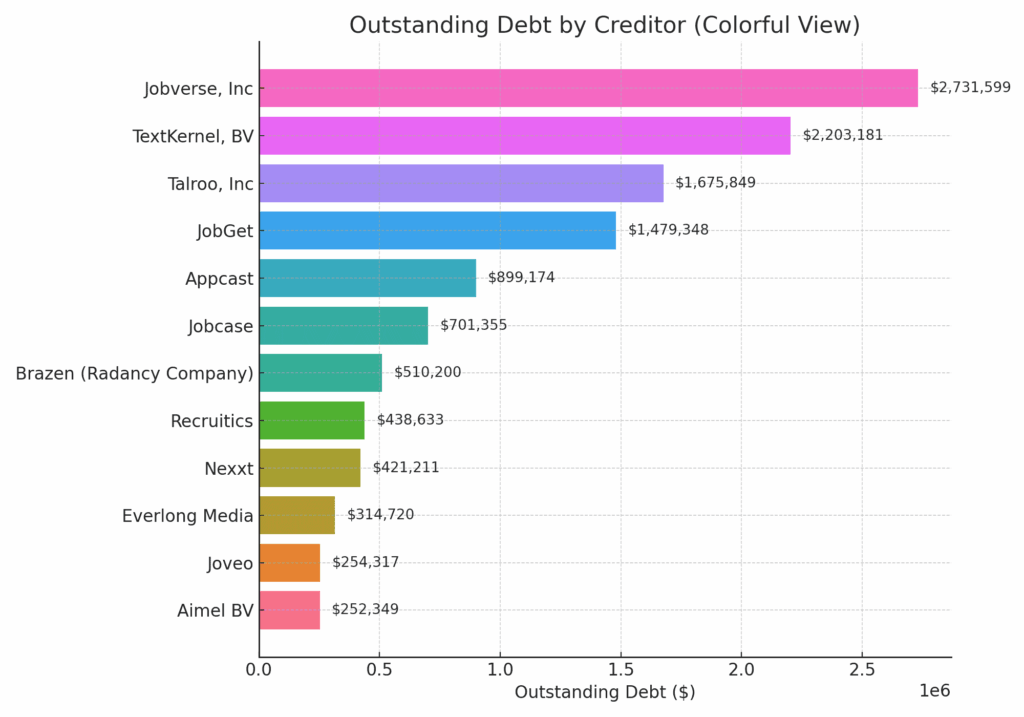

Based on the filing, here is where the vendors in our ecosystem stand.

Will these vendors see any or part of their debts recouped in the bankruptcy process?

This will be the question every one of us should be watching closely.

What Happens Next?

On average, a bankruptcy case takes 18 months to be discharged. The timeline for settling this one — and any hope of payment for unsecured creditors — is, at best, completely unknown.

This is already a complex case. Now add in the fact that JobGet has agreed to act as a “stalking horse” bidder, and the timeline becomes even more drawn out.

Side Quest: Stalking Horse Defined

From Wikipedia: A stalking horse offer is a bid for a bankrupt firm or its assets arranged in advance of an auction to serve as a baseline (or “reserve”) bid. The intent is to maximize the value of the assets or avoid lowball offers during a court auction.

To secure a stalking horse, the debtor may offer bidding protections — like breakup fees — to entice a strong opening offer. That offer sets the floor for the auction and can drive up the final sale price, ideally benefiting the debtor and its estate.

Does CareerBuilder + Monster Continue to Operate?

The plan is yes. The reality? That seems questionable. The company has secured a mere $20MM term sheet from BlueTorch Capital to continue operating through the bankruptcy and bidding process.

But $20MM isn’t much when you owe some of your top partners — including Google — more than $14MM. These are the very partners who drive traffic and revenue to the organization.

Is it expected that the job boards and aggregators will just turn the collective programmatic spigot back on? Why would any of us do that?

🚨Reality Check

There’s so much to unpack here.

I’ve gone down dozens of rabbit holes since this filing landed in my inbox Wednesday morning — and there’s still plenty of work ahead to unravel and document how we got here… and how we prevent it from happening again.

At the end of the day, what really matters is this: a lot of people were irresponsible — and probably, in more cases than my optimistic self would like to admit, acted with intent.

That behavior enriched a few and is now going to cause real, short-term pain for many others: more layoffs, more job offers that never materialize, continued downward pressure on performance, and greater expectations of quality — with little to no increase in revenue for those delivering it.

Brace yourself: The after shocks aren’t over yet.

Until next time,

The Doc

[Want to get Job Board Doctor posts via email? Subscribe here.]

Comments (0)