Human First: Randstad Abandons Monster Employees with a 49% Shrug

Happy Friday, Job Board Doctor friends. It is another beautiful July Friday here in the south of Portugal. The sun is shining, the padel is plentiful and the summer festivals are well underway.

Happy Friday, Job Board Doctor friends. It is another beautiful July Friday here in the south of Portugal. The sun is shining, the padel is plentiful and the summer festivals are well underway.

Still there is no rest for the Job Board Doctor team as the CareerBuilder + Monster Bankruptcy saga continues to rage on.

This week, I want to focus on

- What’s happening with Monster employees outside of the United States,

- The responsibility I believe Randstad bears for those employees, and;

- Where things stand as of this writing.

Randstad, Apollo & the Joint Venture: A Plan to Abandon Europe from the Start?

In September 2024, when the Joint Venture was created between Apollo and Randstad to combine CareerBuilder and Monster into a single entity, the writing appeared on the wall.

Apollo doesn’t rebuild distressed assets — it dismantles and destroys. That’s exactly what we’ve all watched it do to CareerBuilder and its properties since 2017.

So, when Randstad joined forces with Apollo and chose to retain 49% ownership, how could we possibly believe the executive team wasn’t fully aware this would be the outcome from the start?

If they weren’t, I have a lovely river in Portugal I’d love to sell them — for a great price.

Yet I am quite certain the Randstad and Monster Executive Leadership Team, at least in part, were fully cognizant of the destiny they willingly created for the employees they claim to support.

According to a press release issued this week by Monster France’s Workers Council (CSE),

“Randstad disbursed nearly €5 million in 2024 to accelerate vesting of different performance share plans for former Monster executives as part of the joint venture’s launch.”

So, in short, this means Randstad paid nearly €5 million to allow Monster’s top executives to access or “cash out” their company shares or stock options earlier than originally planned.

Normally, these kinds of shareholding or stock plans have conditions — like having to wait a certain period or meet company goals before they can benefit.

In this case, Randstad made an exception and released the funds early for these executives, at the time when the joint venture was launched in 2024.

But Wait, There’s More

Based on a review of the DECLARATION OF MICHAEL SUHAJDA, CHIEF FINANCIAL OFFICER, entered in to the bankruptcy court on June 26, 2025: CareerBuilder brought to the merger loan debt which was secured in 2023. The approximate remaining balance of which is ~$135MM.

Conversely, Monster appears to have brought ZERO debt to the merger.

Yet after the merger, Zen (the holding company for the Joint Venture) issued a senior secured note against the assets of Monster — of which approximately $226MM is still due to Randstad MWW Solutions as the noteholder.

From the filing, page 9.

“Monster Seller Notes. Zen is the issuer under (i) that certain Amended and Restated Senior Secured Note, dated as of December 27, 2024, (ii) that certain Amended and Restated Additional Senior Secured Note, dated as of February 20, 2025, and (iii) that certain Amended and Restated Third Senior Secured Note, dated as of December 27, 2024 (collectively, as amended, supplemented, or modified from time to time, the “Monster Notes”), with Randstad MWW Solutions Inc. as the noteholder thereunder (the “Monster Noteholder”). Debtors Monster Worldwide LLC, Military Advantage, LLC, FastWeb, LLC, and Monster Government Solutions, LLC are guarantors under the Monster Notes (collectively with Zen, the “Monster Note Parties”). The Monster Notes mature on July 31, 2026 and September 16, 2029 (depending on the tranche). The Monster Notes are secured by substantially all assets of the Monster Note Parties, subject to customary exceptions. As of May 31, 2025, the amount outstanding under the Monster Notes is approximately $226.1 million.”

Financial “engineering” at its finest?

No Bidders for the European Commercial Business

So this takes us up to the auction. As CEO Jeff Furman wrote in his email to employees following the completion of the auction last week,

“Unfortunately, no bidders emerged for our international commercial businesses during this process.”

However, this appears to be a bit of a misleading statement by the CareerBuilder + Monster CEO. There were no bids, but there was interest in the international commercial business.

Note, he did not say “our international commercial business,” but international commercial businesses (plural). This distinction is important because under the Monster Worldwide organization exist multiple country-level business units, including France, Germany, Austria, and Italy.

According to discussions with the Job Board Doctor team, interest for parts of the international business did emerge but were unsuccessful for a variety of reasons.

One of those potential bidders is speculated to be Stepstone, who reportedly expressed initial interest in acquiring the German business unit, as well as another major EU country.

(Our team has reached out to the Stepstone team seeking comment or clarification but has yet to hear back. This article will be updated with any new information as it is received.)

Why would the organization — including Randstad with 3 board members as part of the Joint Venture — not seize an opportunity to bring in additional dollars during the fire sale and support, in some part, the continued employment and business operations of its international employees?

Is the international business considered non-viable?

Non-viability does NOT appear to be the case — at least not in certain markets.

For example, I spoke with German market experts this week who told me:

“The German business would be profitable before deducting the massive shared services cost from Monster Global. They made 15 million in revenue in 2024 and 20 million in 2023.”

Yet we believe the Monster European business units are in various states of financial distress with many employees uncertain if they will be paid in August — and neither the Joint Venture nor Randstad have taken steps to rectify it.

You may ask: if the market-based business units are profitable, why don’t they have the cash on hand to continue operations through the liquidation?

Great question. As mentioned above — extraneous shared services fees, some as high as 35%, were taken off the top of revenue. Then additional fees were added on top of the allocation for services such as shared IT infrastructure, marketing and licensure.

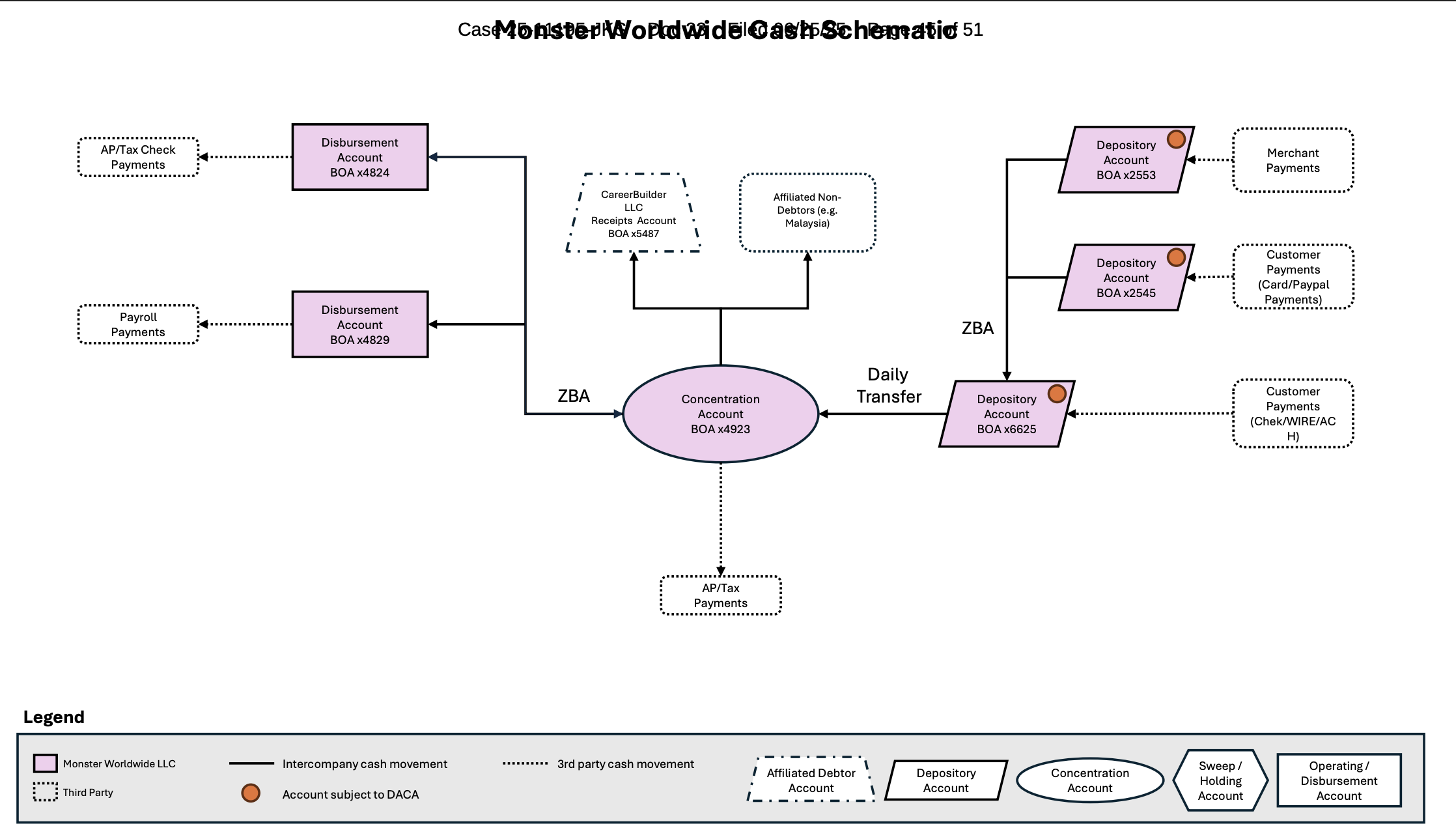

The international payments are received in a series of depository accounts, which are owned and controlled by Monster Worldwide. Budgets are set and controlled by the U.S. entity, which disburses funds to the country-level accounts for certain operational expenses such as payroll, etc.

From this motion in the bankruptcy case – MONSTER WORLDWIDE CASH MANAGEMENT SCHEMATIC. Page 45

To Add Insult to Injury

Let’s put a bow on this with a little more indignity for Monster employees.

In a motion filed with the bankruptcy court, the Joint Venture advises they will be setting aside an award amount of $1.2MM for “key transaction employees” who supported the asset sale.

From this motion in the bankruptcy case – TRANSACTION AWARD PLAN. Page 9

“As of the petition date, the total award amount that may be due and owing to the Key Transaction Employees — should they satisfy the targets set forth in their respective award agreements — is $1,200,000 (collectively, the “Transaction Awards”). For the avoidance of doubt, the Debtors are not seeking authority by this Motion to pay the Transaction Awards and reserve all rights to do so by separate motion.”

Who are these employees? Certainly not the rank and file who keep the wheels of the business turning every single day.

Those employees are being abandoned.

For example, in May 2023, Randstad signed an agreement with French employees to support them in case of company failure, including redeployment, retraining, services for seniors, and more. This agreement is valid until 2027.

According to Les Talent Narratifs, fulfilling the obligations under this agreement would cost Randstad ~€3MM or $3.5MM USD.

To date, Randstad has washed their hands of the agreement as a minority (49%) shareholder.

🚨Reality Check

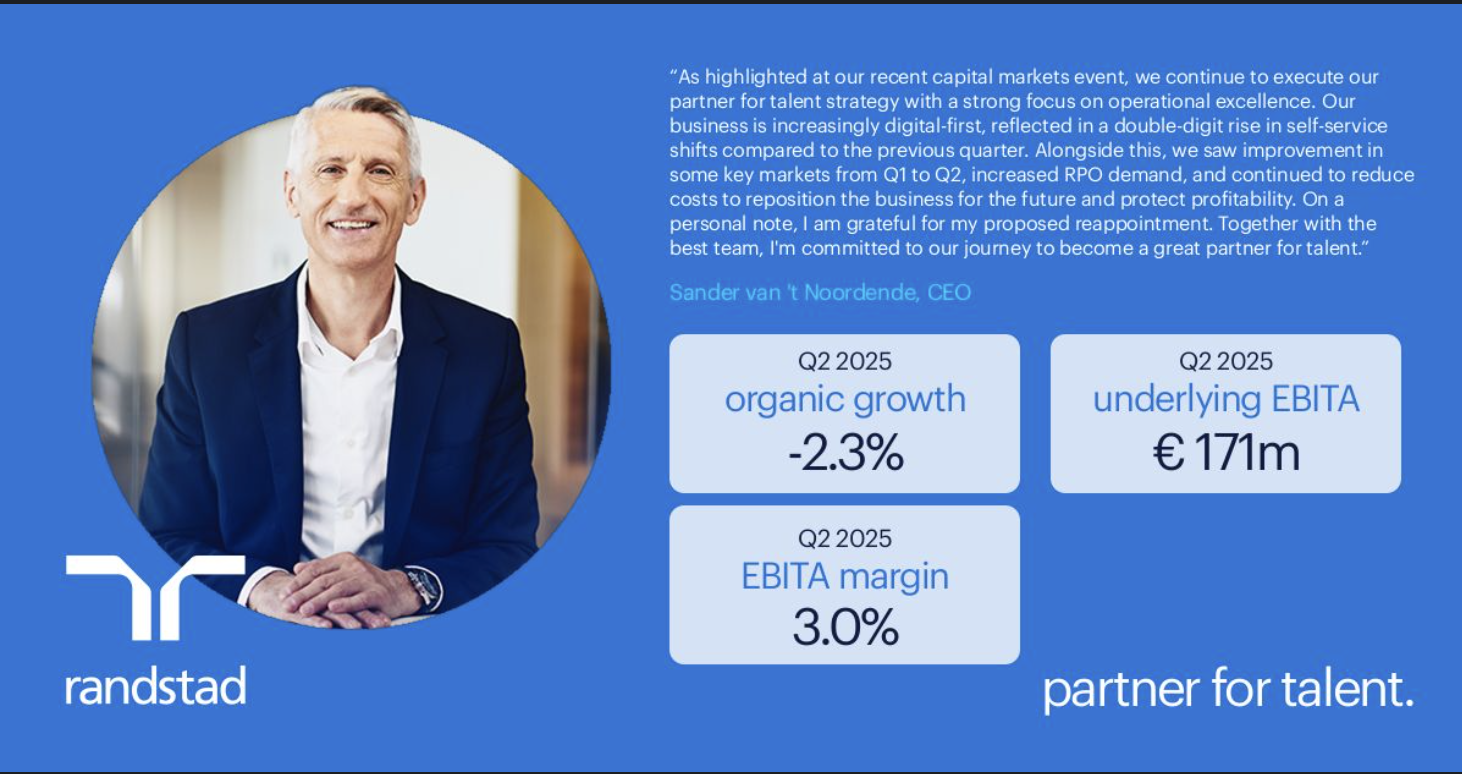

Just this week, Randstad proudly announced a Q2 EBITA of €171MM.

Yet, this €3MM for French employees is not an option?

What would the cost be to provide a smooth transition for affected Monster employees? It wouldn’t break the bank.

Yet, the reality is the governments (and taxpayers) of the affected employees will likely have to stand in the place of the responsible parties to provide support.

The responsible parties are Randstad and Apollo.

Corporate welfare in Europe is not something this American expected to see.

Until Next Time,

Julie “The Doc” Sowash

[Want to get Job Board Doctor posts via email? Subscribe here.]

A sociopath is a term used to describe an individual with antisocial personality disorder (ASPD). ASPD is a mental health condition characterized by:

– Persistent disregard for social norms and laws

– Deceitfulness and manipulation

– Impulsivity and aggressiveness

– Lack of remorse or guilt

– Shallow emotions and empathy

– Superficial relationships

Sociopaths often exhibit a charming and manipulative personality, but they may also engage in criminal or harmful behaviors without remorse.

The same apply to Malaysia center ,they are about to start the liquidation process, No severance ,no support from the company for employees who has been with monster since the beginning of this center.