Key Labor Trends in Europe

Guest post: Michael Woodrow, President at Aspen Technology Labs, Inc.

Guest post: Michael Woodrow, President at Aspen Technology Labs, Inc.

While the US labor market shows signs of cooling, Europe tells a more varied story. This month, we take a closer look at key labor trends in Europe including the UK, Germany, and France.

So, what’s happening in Europe right now?

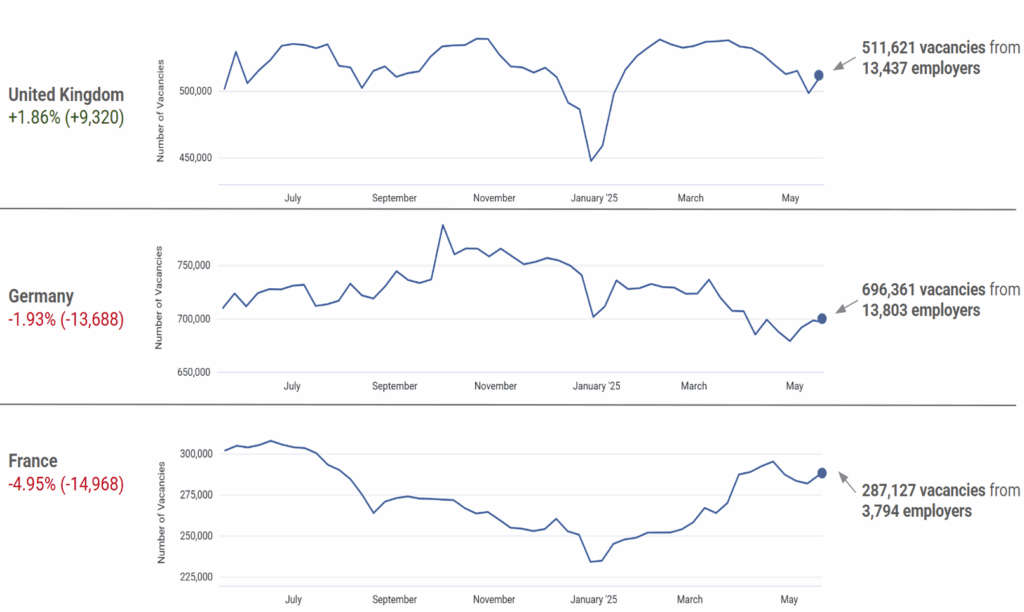

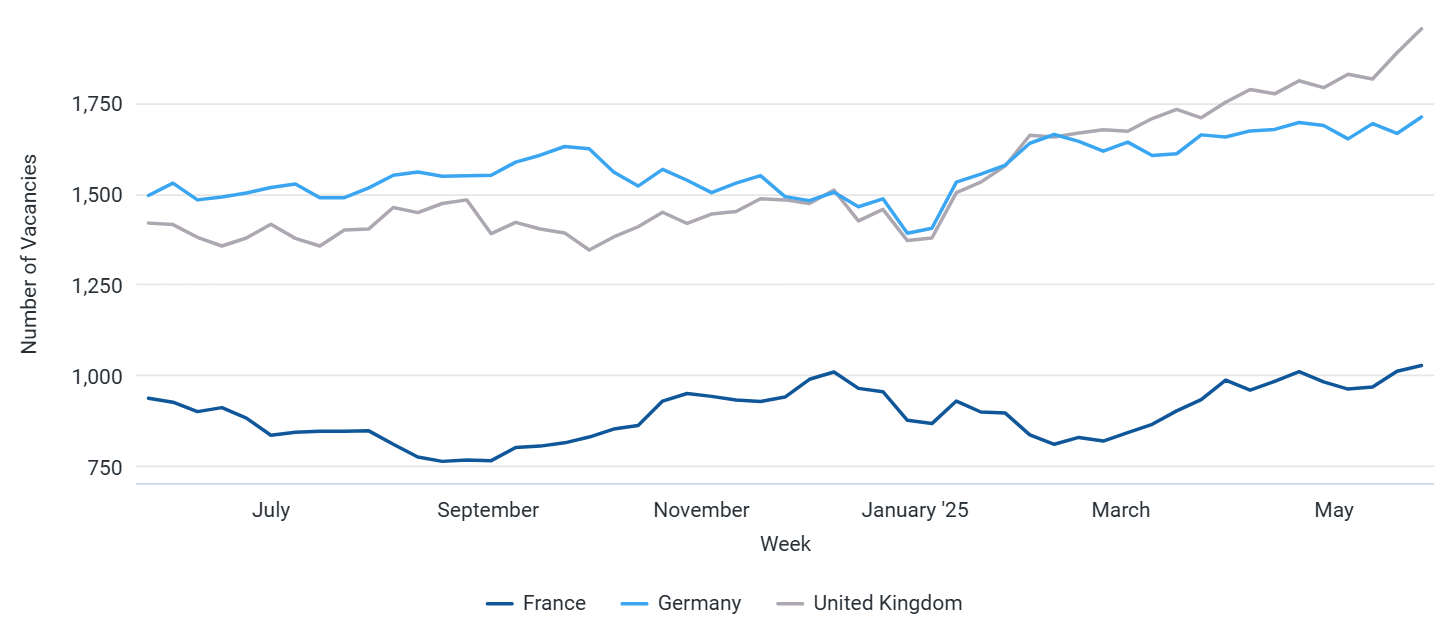

Job postings are up 1.86% year-over-year (YoY) in the UK, with over 13,000 employers actively hiring – a sign of cautious optimism. In contrast, Germany’s job postings are down 1.93% YoY, and France has seen a sharper decline of 4.95% (Figure 1).

We’re tracking job data in these key European markets daily, allowing us to draw valuable comparisons with the US labor market.

Figure 1: Total Vacancies Trend for UK, Germany & France, last 12 months (not adjusted)

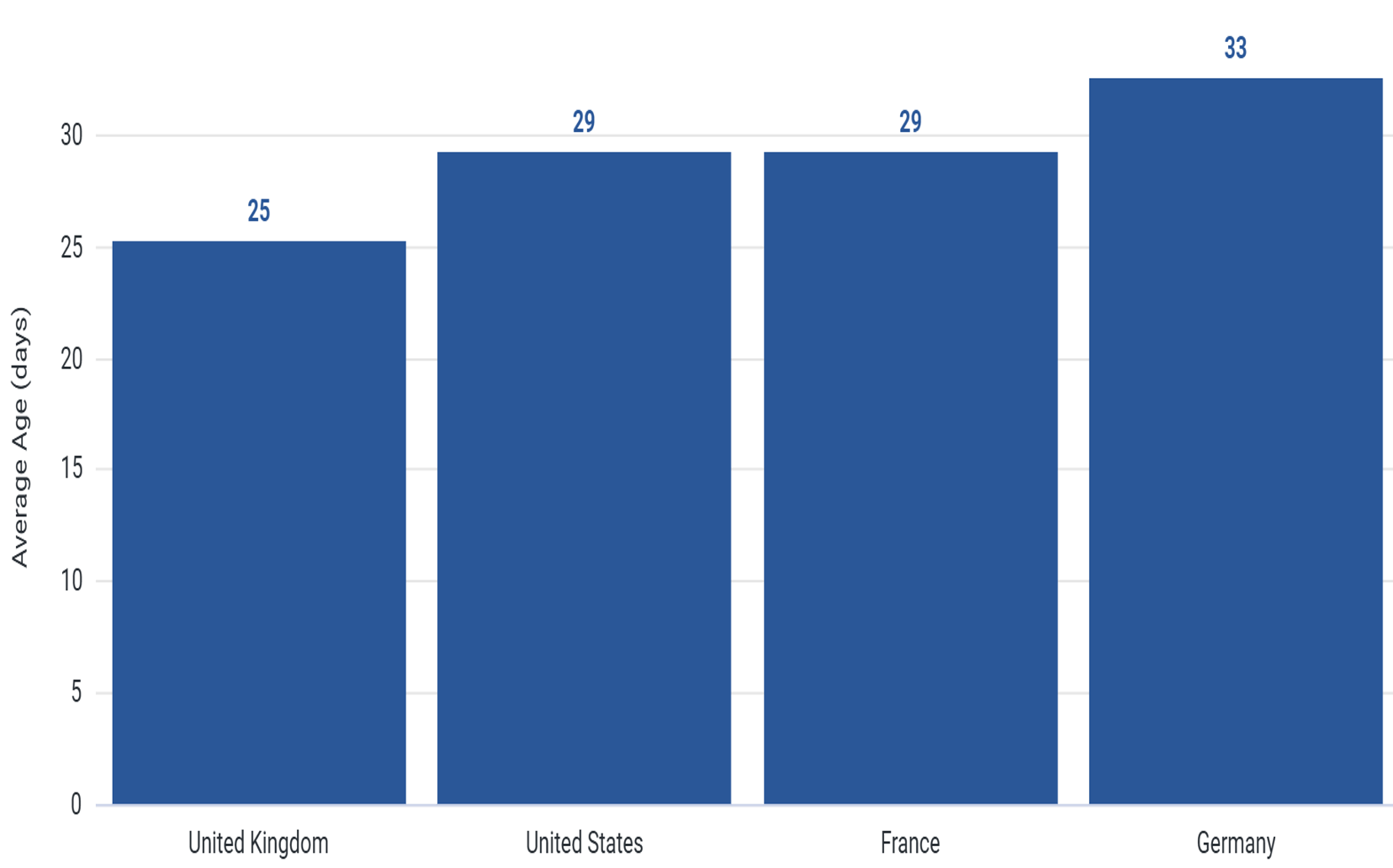

The average vacancy duration in the UK is 25 days, shorter than the 29-day average in the US and France. Germany has the longest duration, at 33 days (Figure 2).

Figure 2: Vacancy duration

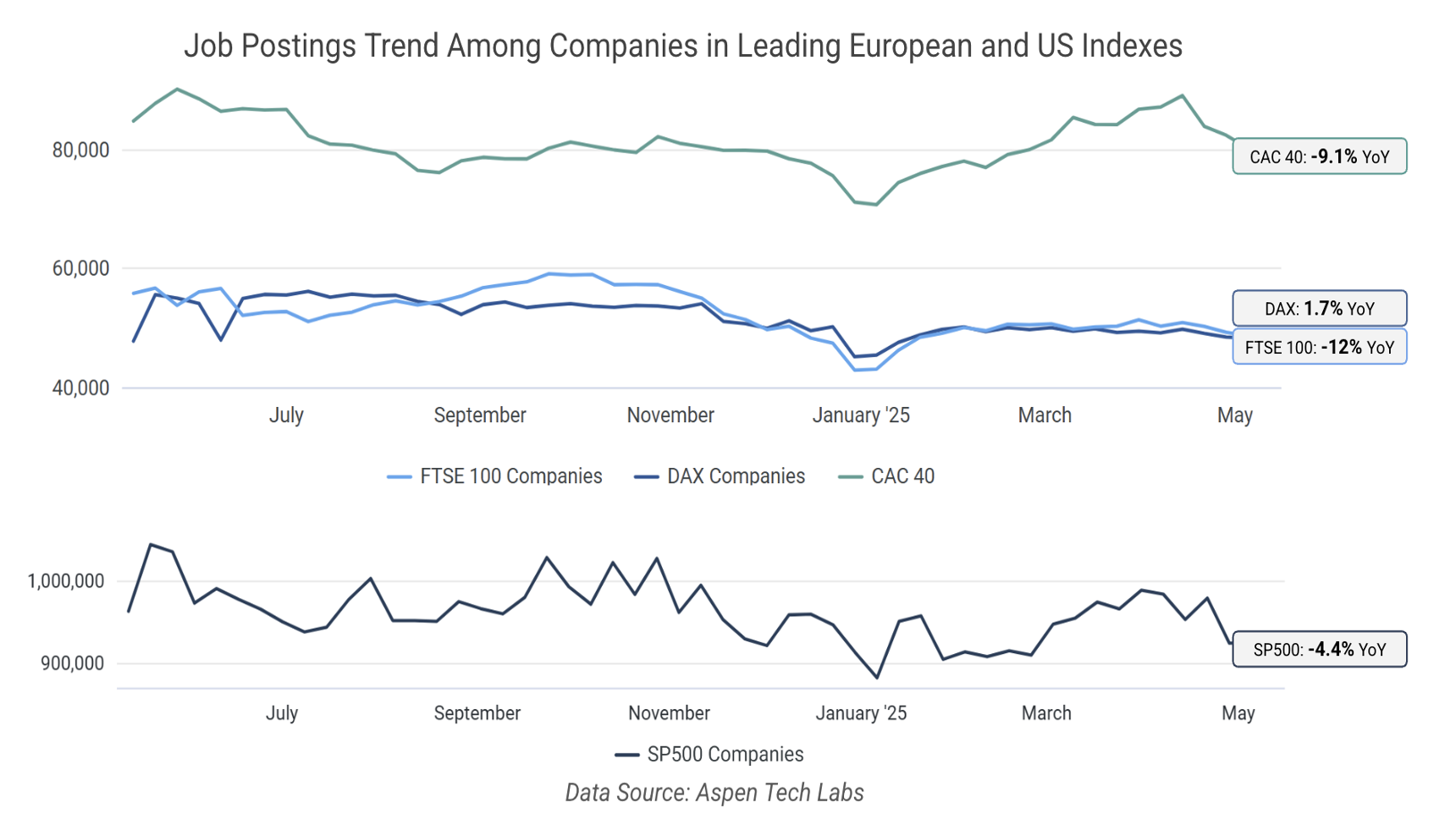

Looking at job posting trends among leading companies in major European and US stock indexes, we see a mixed picture.

Job postings among companies in the CAC 40 (France) and FTSE 100 (UK) have declined YoY (Figure 3), reflecting a more cautious hiring environment in these markets. Germany’s DAX has seen a modest 1.7% increase in job postings, which may be attributed to the strength of its industrial sector.

However, this growth comes against a backdrop of growing uncertainty, particularly related to tariff tensions between the US and Europe.

Recently, US President Donald Trump agreed to extend the deadline for negotiating tariffs with the European Union by more than a month. Initially, he announced a 20% tariff on most EU goods, which he later reduced to 10% to allow time for talks. But on Friday, Trump expressed frustration with the slow pace of negotiations and threatened to raise tariffs as high as 50% by June 1.

Across the Atlantic, the S&P 500 (US) shows a 4.4% YoY decline in job postings, highlighting a cooling labor market. The potential for escalating trade tensions, combined with other macroeconomic challenges like inflation and interest rates, continues to shape corporate hiring strategies on both sides of the Atlantic.

Figure 3: Job Postings Trend Among Companies in Leading European and US Indexes

Granolas vs. Market Indices

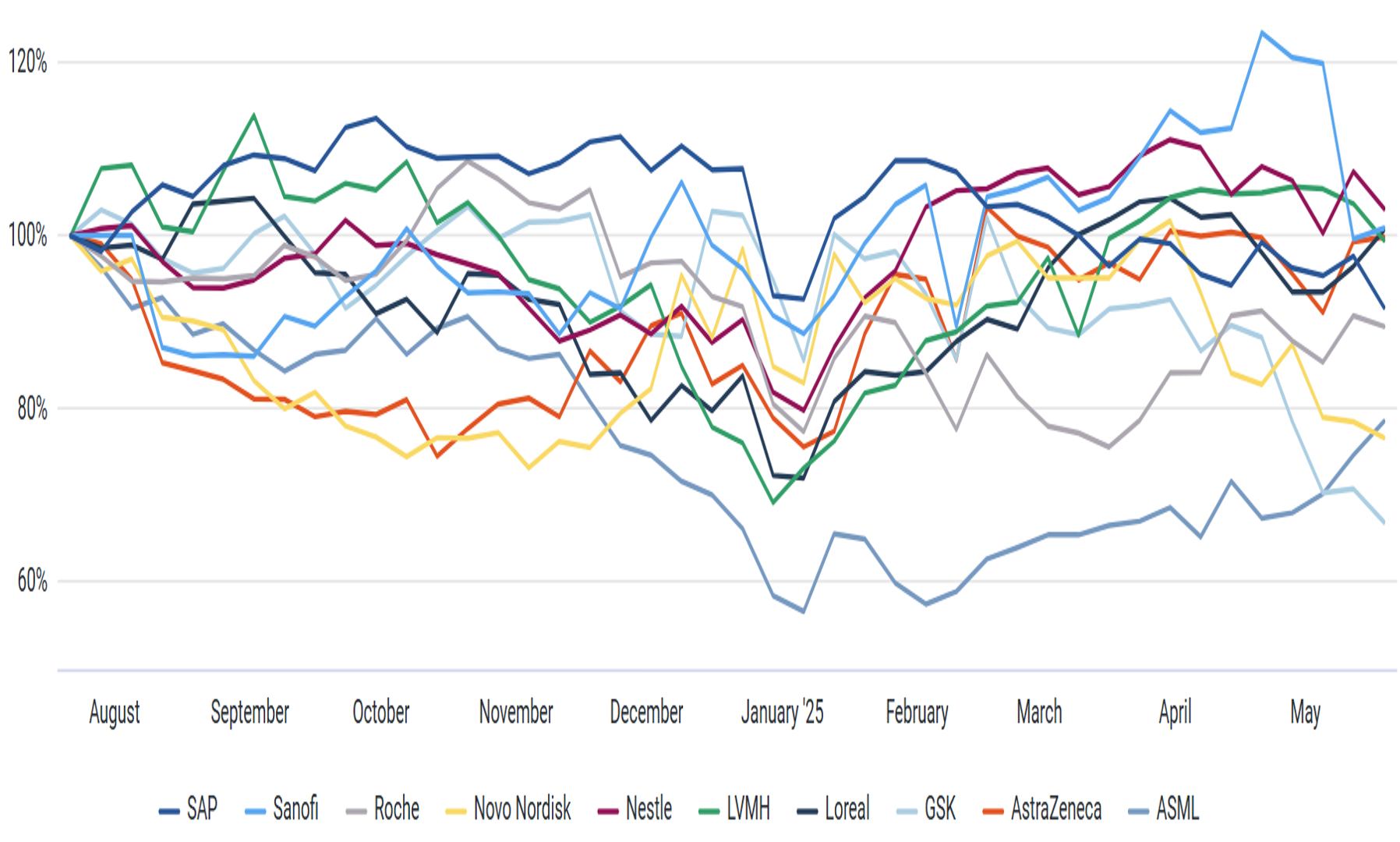

When we look beyond broad market indices and focus on specific companies driving Europe’s equity markets, the Granolas group stands out.

For those unfamiliar, the Granolas is a nickname for Europe’s eleven largest and most influential stocks, spanning five sectors, and acting as the European counterpart to the Magnificent Seven in the US.

This group includes pharmaceutical giants like GlaxoSmithKline (GSK) and Novo Nordisk, tech leaders such as ASML and SAP, and consumer powerhouses like Nestlé, L’Oréal, and LVMH.

The Granolas are considered the backbone of European markets, propelling much of the equity growth despite broader economic headwinds.

Interestingly, while GSK and Novo Nordisk have seen their stock prices rise this month, we see a more cautious story in the job market. GSK’s job postings are down 33% YoY, and Novo Nordisk’s postings are down 23% YoY (Figure 4). This suggests that while hiring has slowed—likely a strategic move amid market uncertainty—it doesn’t necessarily signal a freeze or contraction in business performance. Instead, it could reflect more selective hiring or a focus on operational efficiency.

On the flip side, Nestlé, L’Oréal, and Sanofi—also part of the Granolas—are showing modest positive trends in job postings, with increases of 3%, 1%, and 1% respectively.

This mixed picture highlights a key point: hiring trends don’t always move in lockstep with stock market performance. Companies may be growing in market value while pulling back slightly on hiring, as they navigate a complex macroeconomic landscape.

GRANOLAS Hiring Trends

Figure 4: GRANOLAS Hiring Trends Since July 2024

AI Jobs in Europe

When we look at specific sectors, the AI job market across Europe continues to show impressive growth. In the UK, AI job postings are up 37.6% year over year, in Germany, they’re up 14.9%, and in France, they’ve seen a 9.6% increase (Figure 5).

Figure 5: AI Vacancy Trend

Klarna’s AI Gamble

This steady rise reflects the broad enthusiasm for AI technologies across industries, from healthcare to financial services. But beneath the headlines of AI innovation lies a more complex story—one best illustrated by Klarna, the Swedish fintech giant known for its Buy Now, Pay Later services, AI-powered financial tools, and checkout solutions for major global retailers.

Klarna made waves with its bold AI strategy. It replaced 700 support roles with AI solutions, it introduced an AI-generated CEO avatar as a marketing stunt, and it sought to cut costs aggressively while eyeing an IPO.

However, the company’s hiring trends reveal the real impact of these decisions. After peaking at 169 open job postings in September 2023, Klarna’s hiring slowed drastically. By mid-May 2025, it listed just 11 open roles—a 94% drop in under two years (Figure 6).

Figure 6: Klarna Hiring Trends Since 2023

Interestingly, recent news suggests a partial pivot: following customer backlash and quality concerns, Klarna is reintroducing human-led services in key areas. Their CEO even issued a public apology, acknowledging that AI “is not yet a full substitute for human expertise.” (Fortune article).

Today, Klarna’s remaining open roles focus on business development, compliance, risk management, and delivery management, distributed across 10+ countries.

This case is a powerful reminder that while AI can improve efficiency, it isn’t a cure-all. Hiring data shows how decisions around automation and restructuring shape real teams, affecting operations, morale, and growth across different markets and timelines.

In fact, Alex Chukovski highlighted Klarna’s story during his AI talk at Job Boards Connect, sparking a conversation about the balance between AI adoption and the human touch in customer service and beyond.

Overall, the European labor market is a mixed bag—while the UK shows modest growth in job postings, Germany holds steady, and France continues to see declines. AI job postings remain a bright spot, especially in the UK, but shifts in company strategies—like Klarna’s pivot—underscore the complexity of automation’s impact on the workforce. Trade tensions, including tariffs proposed by the US, are adding another layer of uncertainty for European markets.

Spotlight on Hiring Trends in HR Tech & TA Tech

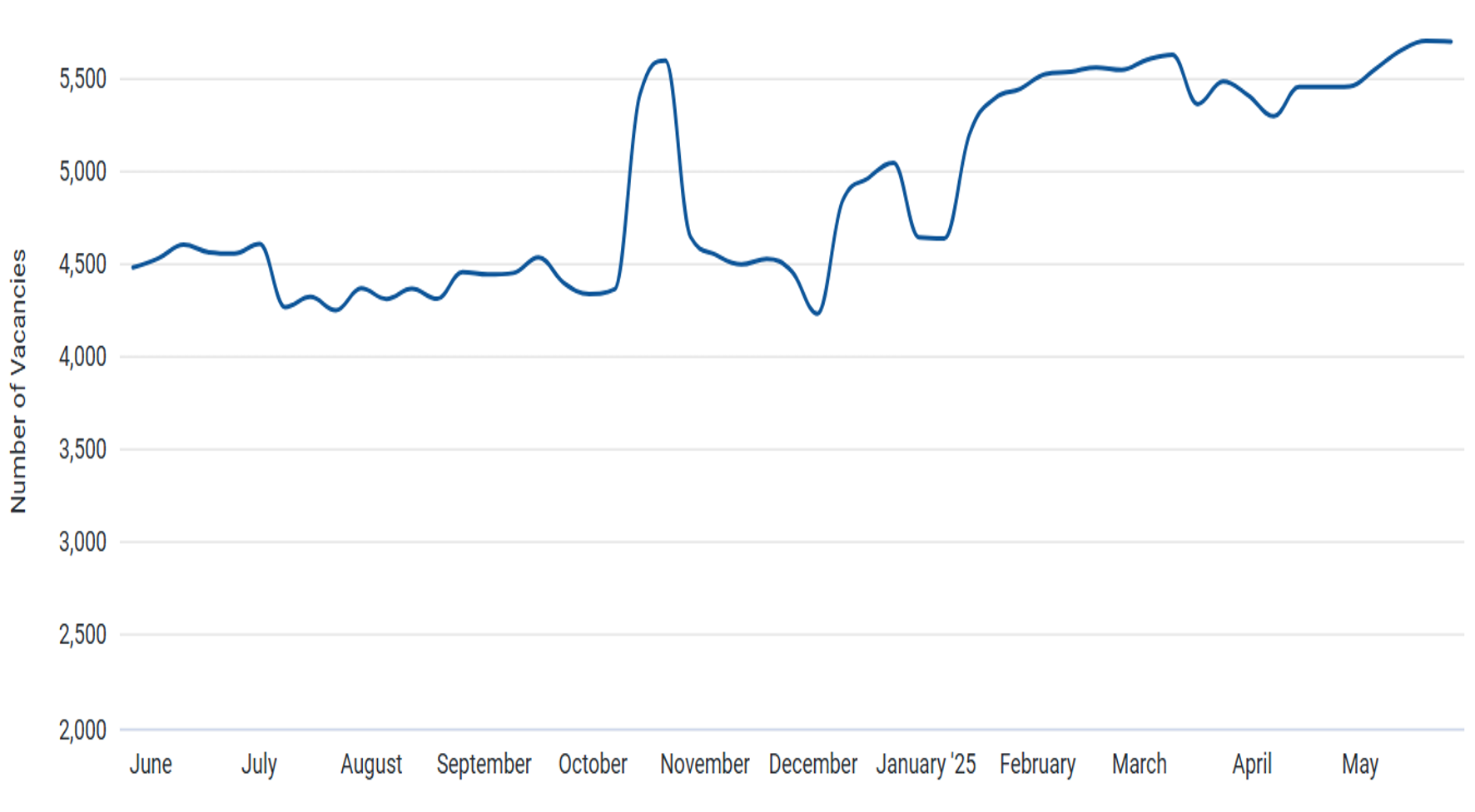

On a positive note, we’re seeing strong momentum in the HR and TA Tech sector, with global job postings up +27.2% YoY—a promising sign for the industry’s resilience and growth (Figure 7).

Figure 7: Vacancy Trend from Top 100 HR / TA Tech Companies Globally

That’s all from me for today—stay tuned for the next update.

Michael Woodrow – President at Aspen Tech Labs, Inc. | Founder at Healthcare Data Analytics, Inc.

Catch up on our April 2025 US Labor Market Update in partnership with the Job Board Doctor.

[Want to get Job Board Doctor posts via email? Subscribe here.]

Comments (0)