The State of the Job Market: Key Shifts from Q2 2025

Guest post: Michael Woodrow, President at Aspen Technology Labs, Inc.

Guest post: Michael Woodrow, President at Aspen Technology Labs, Inc.

As we moved through the second quarter of 2025, the U.S. job market sent a message: things are still moving, but maybe not as fast as they were earlier in the year. Job postings dipped slightly, pay continued to rise, and some surprising shifts occurred across sectors like AI and marketing. The story gets even more interesting when we zoom in on the state level and niche industries.

Let’s break it down.

Job Postings Are Slipping, But There’s Still Movement

At the start of April, there were around 6.4 million active job postings in the U.S. By the beginning of July, that number had dropped by 2.8% to 6.2 million. That slowdown was more of a soft landing than a sharp decline. Overall, more than 14 million unique postings appeared during the quarter from over 151,000 employers in 18,000+ cities.

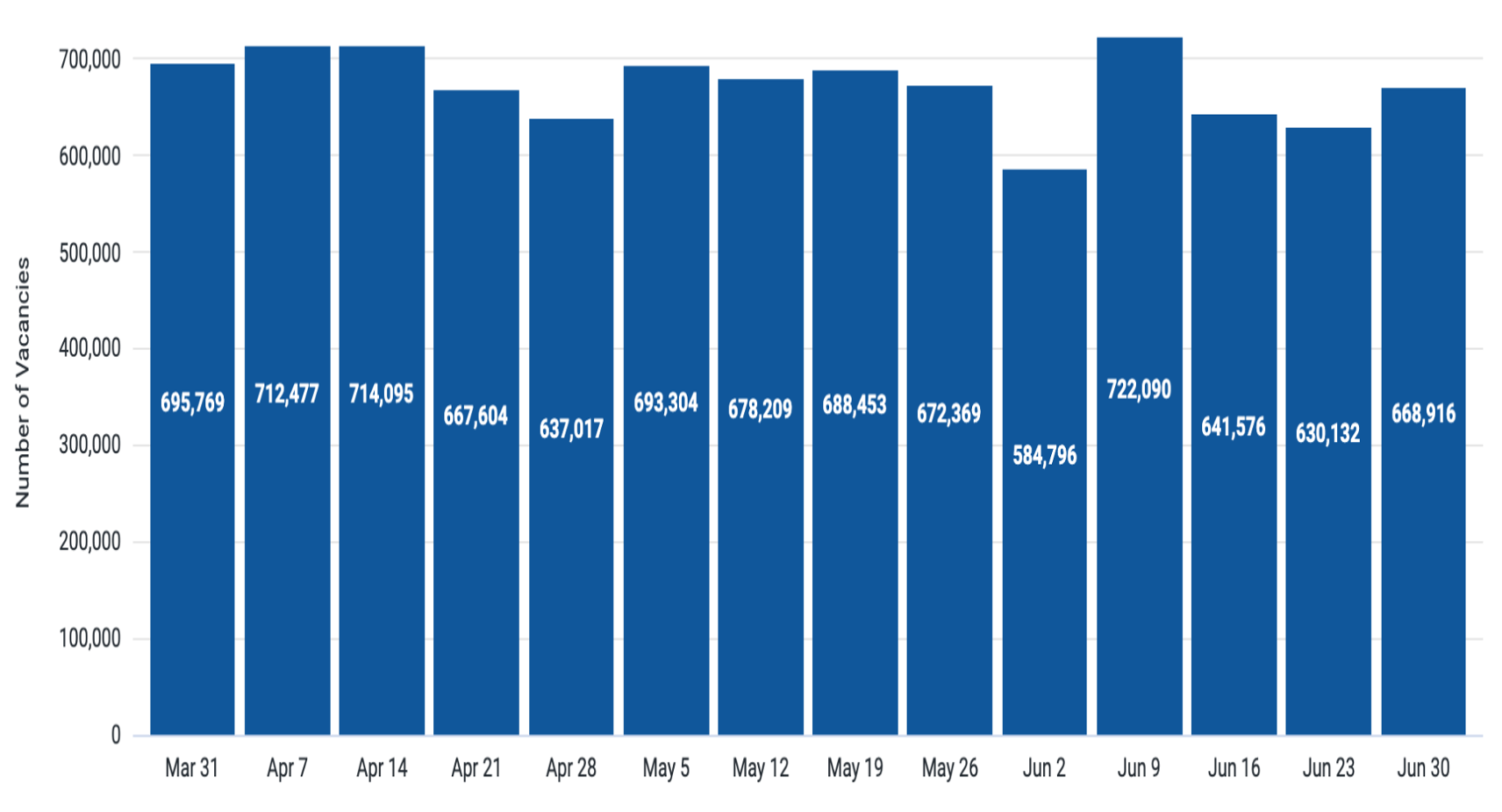

Figure 1: U.S. Weekly Job Vacancy Totals

Hiring didn’t grind to a halt; it shifted. Weekly posting volumes stayed robust, averaging nearly 672,000 new job postings per week and peaking at over 722,000 in early June. The most posted job postings were for Registered Nurses, Sales Reps, Teachers, and Sales Associates, roles we’ve consistently seen at the top due to turnover and steady demand.

Pay Is Up, And So Is Transparency

Wages continued to rise, although modestly. By July, the median full-time salary hit $62,494, a 3.3% increase since April. Part-time rates nudged upward too, landing at $18.23/hour.

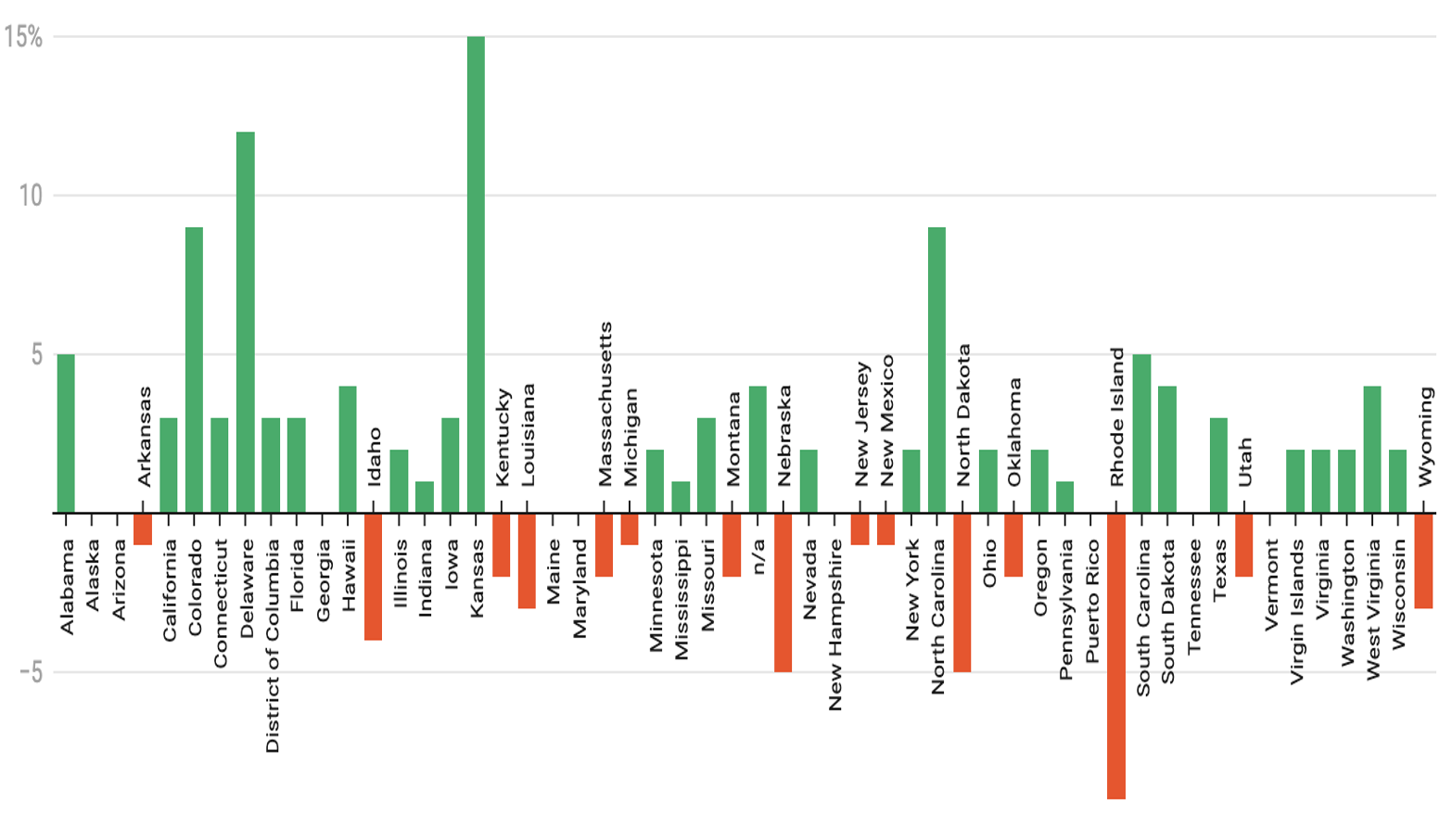

Figure 2: Median Full-time Salary YoY Percent Change by State

But more notable than the pay itself is how often companies are willing to share it upfront. Nearly half (49%) of all job listings now include salary information, up from just 40.8% a year ago. Colorado, Washington, and Hawaii lead in transparency, showing pay in more than 76% of their job ads, while southern states like Mississippi and Alabama still lag behind.

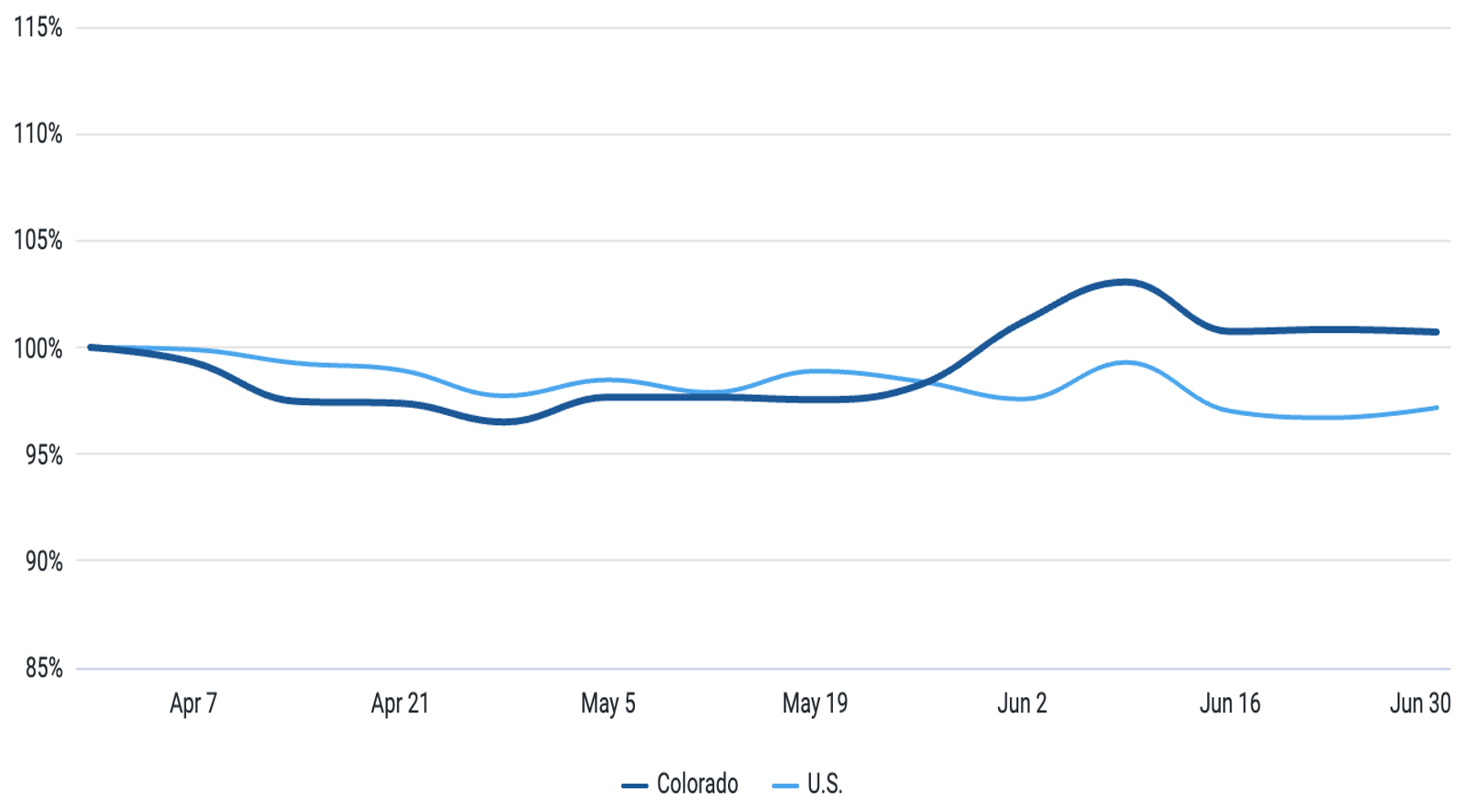

Colorado Shows Quiet Strength

Among the few states to buck the national downward trend in hiring, Colorado stood out with a 0.7% increase in job postings during Q2. While modest, that was enough to rank the state seventh for vacancy growth nationwide.

Figure 3: Colorado Vacancy Trend vs National Average

Healthcare roles drove much of the state’s growth, adding over 3,000 job postings this quarter, followed by nursing and personal services. Median full-time salaries in Colorado rose to $64,823, pushing it up to 11th place nationally for pay. But not all was rosy, entry-level job postings fell 38%, suggesting it’s getting tougher for new grads to land a foothold.

Kentucky Feels the Slowdown

Things looked more subdued in Kentucky. From April to July 2025, the state lost nearly 3,300 job postings, a 3.9% dip that placed it among the bottom half of states for hiring momentum.

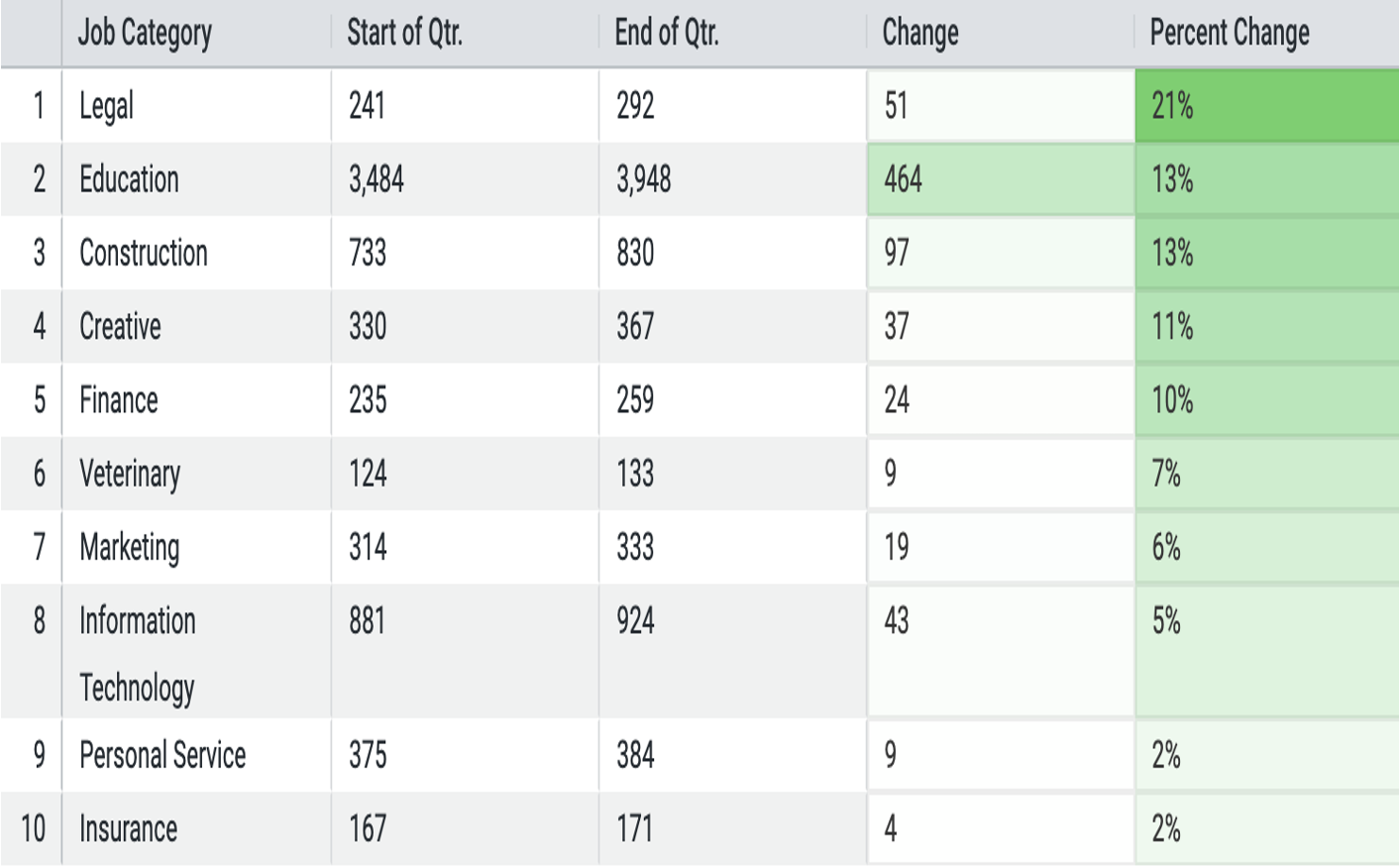

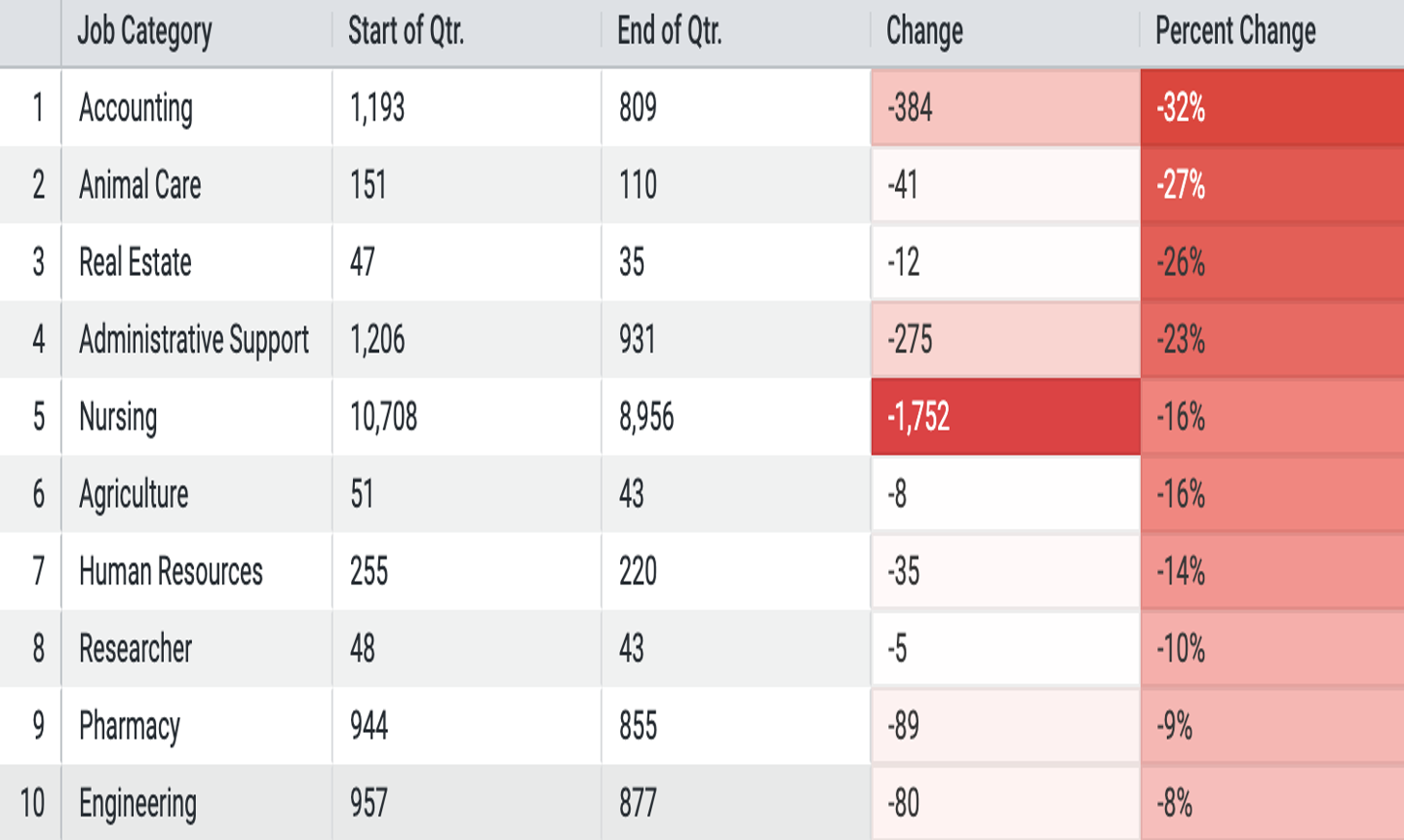

Biggest job losses came from nursing (down 16%), accounting, and animal care, but there were bright spots. Legal roles saw a 21% increase, and education and construction job postings each grew by 13%. Still, the overall mood was cautious. Median full-time salaries in Kentucky rose slightly to $50,003, though the state still ranks among the lowest nationally.

Figure 4: Category – Largest Job Growth

Figure 5: Category – Largest Job Decline

Marketing Job Postings: Senior Roles Up, Entry Roles Down

According to data from Aspen Tech Labs, published in collaboration with Taligence, the marketing job landscape in Q2 2025 showed a clear divergence in hiring patterns. While total marketing job listings declined by 6.7% and new postings dropped more than 13% quarter-over-quarter, leadership hiring gained significant momentum.

- C-level marketing roles surged 34.8% year-over-year

- VP and Senior Director postings rose by 17%

Meanwhile, entry-level roles fell by 15.1%, highlighting a shift in where companies place their investments.

Seattle stood out with nearly 26% growth in marketing salaries and a corresponding increase in job volume. Among disciplines, product marketing remained the highest-paid, with median salaries hovering around $160,000.

The full Taligence Q2 2025 Marketing Job Market Report can explore these findings further.

AI Hiring Goes Mainstream

AI job growth in Q2 2025 wasn’t confined to traditional tech centers like California or New York. According to Aspen Tech Labs data, featured in Veritone’s latest analysis, states like Iowa (+37%), Tennessee (+28.6%), and Kentucky (+13.7%) saw some of the fastest-growing AI-related job markets.

The median advertised salary for AI job postings reached $165,006, significantly higher than the $129,698 median for non-AI IT positions. This growing salary gap underscores the increasing demand and value for specialized AI talent as industries from healthcare to finance continue to embed machine learning, automation, and intelligent systems into their operations.

You can explore these findings in more detail in the Veritone Q2 2025 AI Labor Market Report.

Final Thoughts

Q2 didn’t bring a hiring freeze; it brought recalibration. Fewer entry-level roles, more demand for senior leadership, fewer total postings, but higher salaries. AI is booming, while traditional job categories shift by state and sector.

In times like these, the ability to see the data clearly and act on it makes all the difference.

Michael Woodrow – President at Aspen Tech Labs, Inc. | Founder at Healthcare Data Analytics, Inc.

[Want to get Job Board Doctor posts via email? Subscribe here.]

[Got a tip, document or intel you want to share with the Doc? Tell me.]

Comments (0)