When Job Postings Predict Market Moves: Hiring Data as an Investment Signal

Job Board Doctor Survey: GeT in before it is too late.

Job Board Doctor Survey: GeT in before it is too late.

Your voice matters more than you know.

The Job Board Doctor Global Annual Recruitment Site Survey is your chance to shape the future of our industry, influence how platforms evolve, and make sure the real needs of job boards are heard loud and clear.

It only takes a few minutes, but the insights we gather fuel the strategies, benchmarks, and conversations that will define the next year. Don’t sit this one out—add your perspective and help us write the story of what’s next in recruitment.

👉 Survey Link: https://www.surveymonkey.com/r/G6NZP97

Job Postings Predict Market Moves: Hiring Data as an Investment Signal

Monthly guest post: Michael Woodrow, President at Aspen Technology Labs, Inc.

For investors, an edge often comes from spotting signals the market has not yet priced in. One signal comes from a source often overlooked: hiring data.

Job postings, collected directly from company career sites in real time, provide a window into corporate strategies before they are revealed in earnings calls or SEC filings.

A sudden hiring surge can indicate expansion, contract wins, or new product launches. Conversely, declining vacancies may signal cost-cutting, weak demand, or looming layoffs. Hedge funds and financial institutions have taken notice.

Neudata reports that over 90 percent of institutional data buyers expect to maintain or increase spending on alternative datasets through 2025, with many allocating more than $5 million annually.

In the broader U.S. labor market, job postings in August increased just 0.2% month over month but remain 2.5% below last year’s level, reflecting employers’ caution amid economic uncertainty.

At the same time, traditional data sources like the Bureau of Labor Statistics have come under political fire.

Following President Trump’s dismissal of the BLS commissioner in August, the agency reported the first monthly job losses in over four years and unemployment rising to 4.3%. Economists point to tariffs, stricter immigration policies, and public-sector layoffs as key drivers.

Against this backdrop, Aspen Tech Labs’ real-time vacancy data provides a more timely and stable lens on workforce trends. Unlike lagging official reports, hiring signals reveal shifts in corporate demand for talent as they happen, making them invaluable for both investors and job boards.

Looking at company-level patterns, the predictive power of hiring activity becomes even clearer.

Trends among established and newly public companies show how hiring activity can reliably predict financial performance.

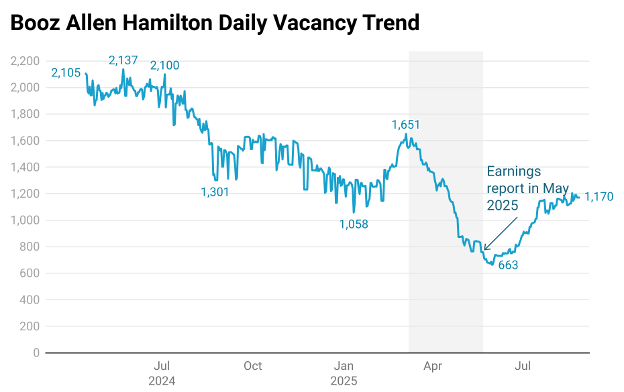

Booz Allen Hamilton

Take Booz Allen Hamilton (NYSE: BAH) as an example: investors were caught off guard by a 16.5 percent share price drop in May 2025 following weak earnings and a soft outlook for 2026. The company also announced layoffs amid federal cost-cutting efforts. Yet the warning signs were there months earlier. Job postings at Booz Allen had collapsed from a March 2025 peak of over 1,600 openings to just above 700 before the earnings date, a 66 percent decline year-over-year. That kind of contraction in demand for talent usually precedes revenue headwinds. Investors tracking postings would have been positioned to anticipate disappointing earnings and adjust accordingly.

Figure 1: Booz Allen Hamilton Daily Vacancy Trend

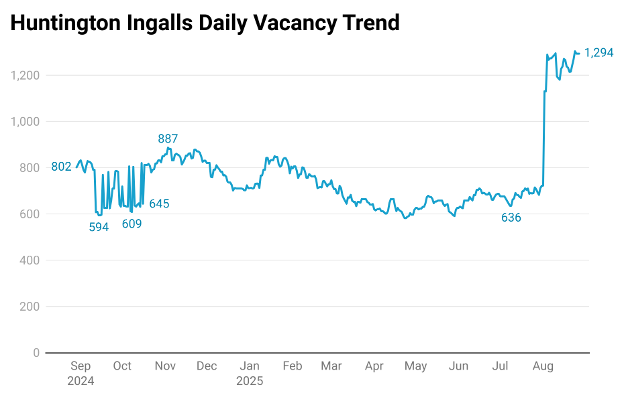

Huntington Ingalls

A very different picture emerges at Huntington Ingalls (NYSE: HII), the U.S.’s largest military shipbuilder. Here, the hiring trend reveals rapid expansion in line with the recent share price increases. Since early August, job postings have surged by nearly 80 percent, with heavy demand for engineers, cybersecurity experts, and data scientists. Shares have risen 41 percent year-to-date, reflecting the company’s contract wins and operational momentum.

Figure 2: Huntington Ingalls Daily Vacancy Trend

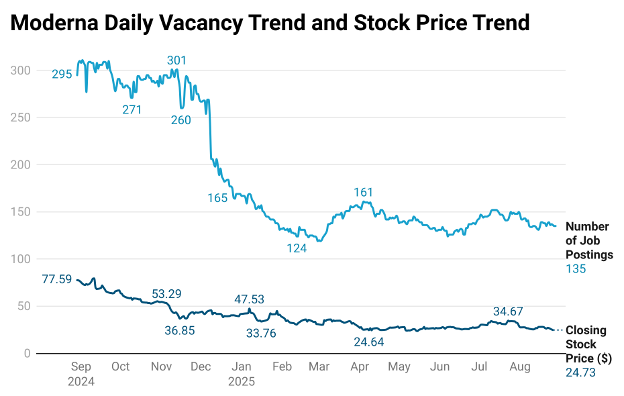

Moderna

The link between job postings and stock performance is perhaps most striking at Moderna (NASDAQ: MRNA). Over the past year, the biotech’s postings have fallen by more than half, while its stock price declined almost in lockstep, down 68 percent. The correlation coefficient between the two trends reached 0.86, showing how tightly vacancies tracked market performance. Moderna later confirmed the weakness with layoffs affecting 10 percent of its global workforce, citing reduced vaccine demand and underwhelming new product launches. Investors who had monitored the vacancy data could have anticipated the downturn well before official announcements.

Figure 3: Moderna Daily Vacancy Trend and Stock Price Trend

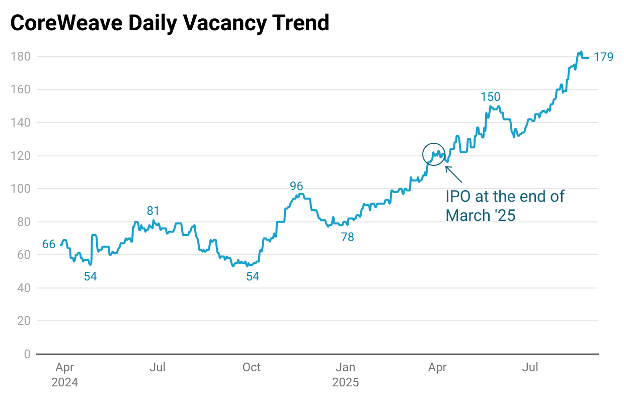

CoreWeave

Hiring data also provides critical insights into firms preparing to go public. CoreWeave (NASDAQ: CRWV) is a perfect example. In the year leading up to its March 2025 IPO, the company nearly doubled job postings, a clear signal of aggressive expansion. After the listing, vacancies climbed even higher, and the stock has since soared 144 percent, supported by triple-digit revenue growth. The hiring ramp telegraphed a growth story before filings confirmed it.

Figure 4: CoreWeave Daily Vacancy Trend

CIRCLE INTERNET GROUP

Circle Internet Group (NYSE: CRCL) followed a similar pattern. Vacancies rose by 45 percent in the six months leading up to its June 2025 IPO, indicating a company scaling up for the public markets. The IPO priced at $31 a share, raising $1.1 billion at a $6.9 billion valuation. Since then, shares are up 39 percent. For investors watching, the steady buildup of vacancies was a clear indication that Circle was preparing for a strong market debut.

Figure 5: Circle Daily Vacancy Trend

KLARNA

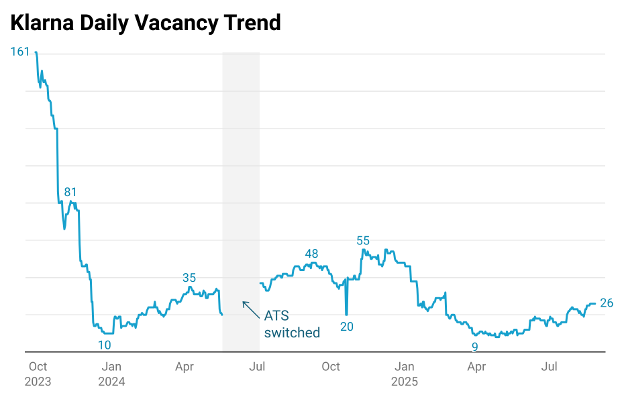

By contrast, Klarna (NYSE: KLAR), with an IPO scheduled for September 10, tells a cautionary tale. Once valued at nearly $50 billion, the company sharply reduced its job postings from over 150 in 2023 to only 20–30 through much of 2025. Reuters has reported Klarna plans to list in the U.S. at a $13–14 billion valuation far below its earlier highs. Here, job postings signaled a deliberate shift in strategy and a reset in expectations.

Figure 6: Klarna Daily Vacancy Trend

Conclusion

The turmoil around the Bureau of Labor Statistics underscores why markets need timely and trustworthy labor intelligence beyond government reports. In September, the agency issued major revisions to prior job reports that confirmed weaker growth than initially reported. These major revisions and ongoing political controversy highlight a broader problem: official data often arrives late, gets revised, and is vulnerable to external pressures.

Aspen Tech Labs fills that gap. By capturing millions of postings directly from company career sites, Aspen provides a high-quality, real-time dataset that investors and job boards can act on immediately. This is not just an HR metric but a forward-looking financial signal that reveals expansion, contraction, and IPO preparation long before earnings calls or SEC filings. In an environment where trust in government data is fading, access to accurate, timely hiring intelligence is no longer optional; it’s a critical edge.

Michael Woodrow – President at Aspen Tech Labs, Inc. | Founder at Healthcare Data Analytics, Inc.

[Want to get Job Board Doctor posts via email? Subscribe here.]

[Got a tip, document or intel you want to share with the Doc? Tell me.]

DISCLAIMER: THIS INFORMATION IS PROVIDED FOR GENERAL INFORMATION PURPOSES ONLY AND SHOULD NOT BE CONSIDERED PERSONAL FINANCIAL ADVICE.

Comments (0)