June 2025 – U.S. Job Market Update

Guest post: Michael Woodrow, President at Aspen Technology Labs, Inc.

Guest post: Michael Woodrow, President at Aspen Technology Labs, Inc.

The U.S. labor market is continuing its slow shuffle into the summer. For the third month in a row, the job market has seen job postings dipped slightly, suggesting that the momentum we saw earlier this year is losing a bit of steam.

However, beneath this cautious headline lies a more nuanced story: companies are still investing in talent where it matters, especially in AI and finance. And transparency? It’s finally going mainstream.

So, where are we now, and what signals can we read from this month’s movement?

Latest Hiring Trends

A Modest Slide, but Not a Collapse

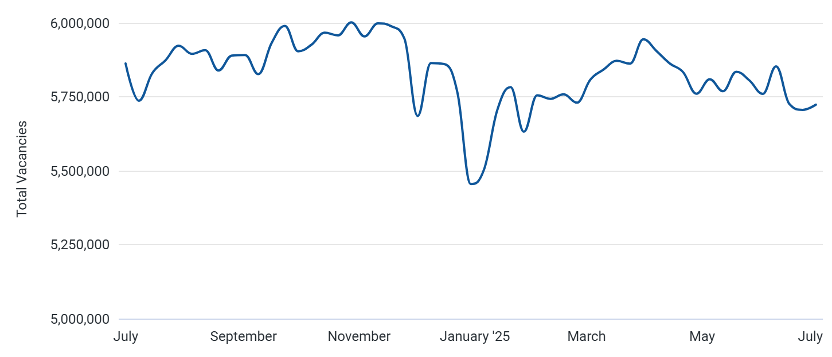

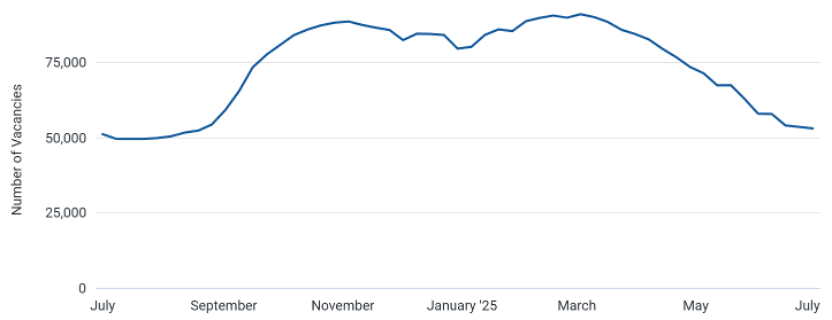

Job postings declined again in June, dropping 0.6% from May and 2.4% compared to June 2024 (Figure 1). It’s not a sharp fall, but it’s enough to show that employers remain conservative in the face of economic uncertainty, tariff tensions, and rising operational costs, which are the top concerns.

Figure 1: Total U.S. Job Vacancies

Still, this isn’t a uniform retreat. Hiring is holding firm in several pockets of the economy, and the pullback appears strategic rather than reactive.

Remote Work: Plateaued, but Here to Stay

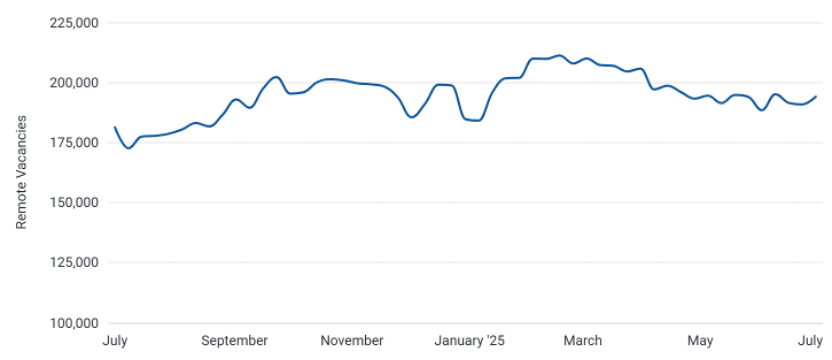

Remote work has stabilized. After explosive growth over the past few years, the number of open remote jobs in June stood at 194,036, a 7% increase year-over-year, and 3% higher than May (Figure 2). While the pace has slowed, remote roles continue to be in demand, particularly in industries like tech, finance, and digital services.

Figure 2: Remote Job Vacancies in the U.S.

What we’re seeing is not the end of remote work but its normalization. It’s no longer a pandemic perk; it’s simply part of how modern teams operate.

Salary trends

Salaries Climb as Employers Compete for Talent

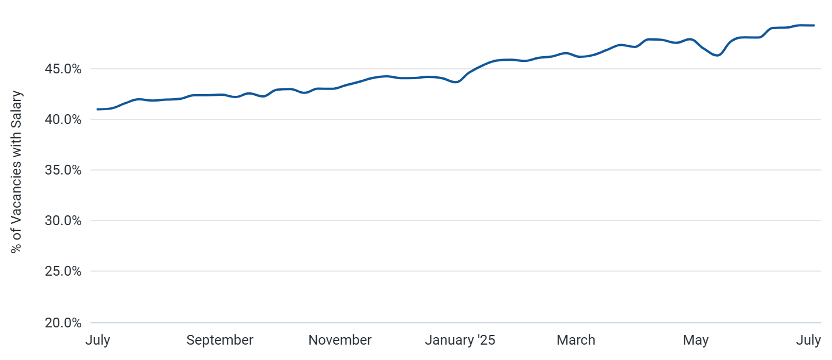

Despite fewer job postings, salary growth hasn’t hit pause. Median full-time pay in June from open postings reached $62,421, marking a 9.1% increase year-over-year (Figure 3). This could be impacted by the mix of open positions this year vs. last year. Month-over-month, it held steady, proof that even amid a hiring cooldown, companies are still willing to pay a premium for the right skills.

Figure 3: Share of U.S. Job Listings with Salary Information

Salary Transparency Hits a New Milestone

One of the most meaningful shifts in the last year has been the surge in salary transparency. Nationwide, nearly 49.2% of job listings now include pay information—up 8.3 percentage points year-over-year and 1.2 points from May.

A major driver of this? New laws, including New Jersey’s transparency mandate, which took effect June 1.

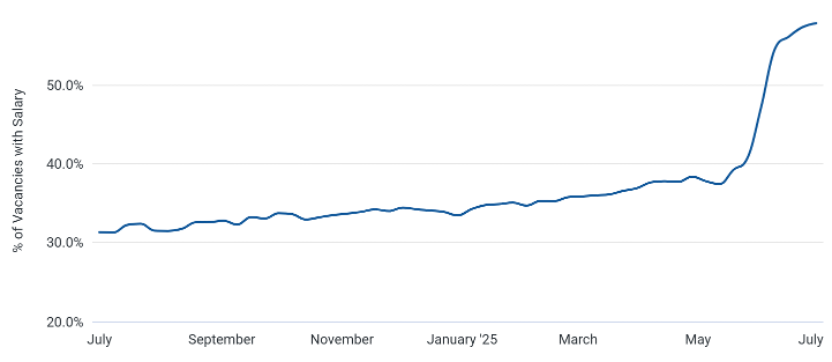

Spotlight: New Jersey’s Mandate Brings Rapid Change

New Jersey is already showing the early effects of its new salary transparency law, and the changes are significant. While job postings have dipped down 4.9% year-over-year and 1.7% since May, transparency has surged. As of June, 57.9% of listings in the state include pay details, a sharp increase of 26.5 percentage points over last year and 10.7 points from just last month (Figure 4).

The median full-time salary in New Jersey from job postings reached $69,805 in June, up 13.5% year-over-year and 3.4% month-over-month. Part-time hourly wages also rose to $18.95, reflecting a 2.43% increase from June 2024. While these figures suggest strong salary growth, it’s likely that the rise is influenced by the sharp increase in salary transparency; more job postings now include pay ranges, which affects the overall calculation. Rather than signaling universal pay raises, the higher median may reflect a broader data set. Still, it points to a shift toward more open and competitive compensation practices as employers adapt to new regulations and evolving candidate expectations.

Figure 4: Salary Transparency Trend for New Jersey

Tougher Market for Graduates

Entry-level candidates face more headwinds. Vacancies containing phrases like “Intern,” “Junior,” or “Graduate” in the job title totaled 53,105, a 3.8% increase year-over-year but down 8.4% from May (Figure 5).

This suggests seasonal adjustments as graduation season ends, but also more cautious onboarding strategies by companies.

Figure 5: U.S. Entry-Level Job Listings

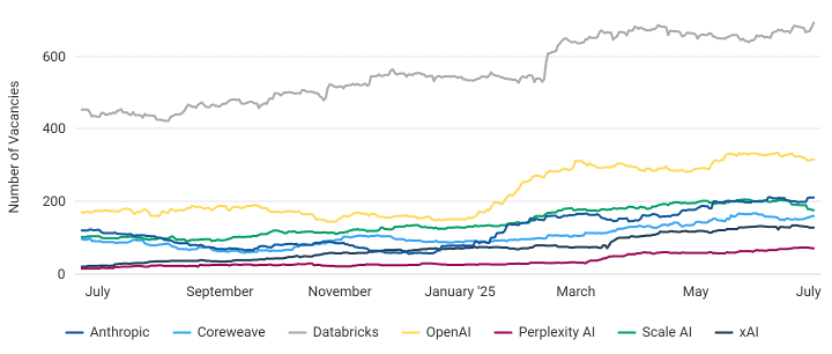

Hiring Surges Among Leading U.S. Private AI Companies

A closer look at hiring trends among selected private U.S. AI companies reveals significant momentum. This is in line with the growth in the overall AI job market and highlights aggressive hiring within a handful of major players. These companies—focused heavily on generative AI and related technologies—are expanding rapidly across engineering, research, and infrastructure roles.

Here are just a few standouts YoY:

- xAI: +568.4%

- Perplexity AI: +400%

- OpenAI: +86.4%

- Anthropic: +76.5%

These aren’t isolated cases. They signal that AI continues to dominate investment and hiring attention, even as other sectors slow down (Figure 6).

Figure 6: Job Posting Trends at Leading Private U.S. AI Companies

Noteworthy Company Trends: Rebounds and Resets

While the broader job market shows signs of caution, certain companies are charting their own growth trajectories.

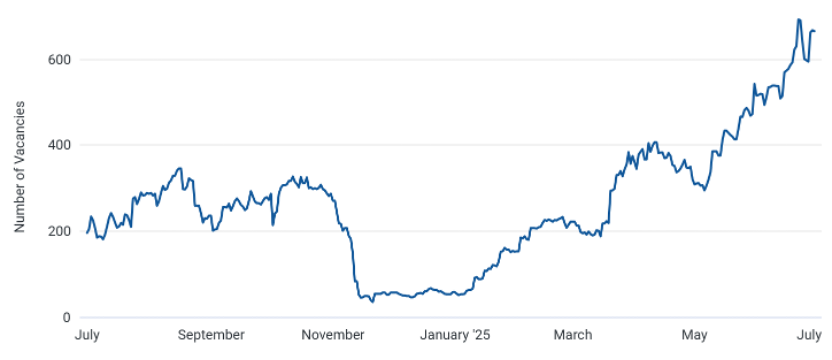

Fiserv: Embracing Digital Innovation

Fiserv has experienced a remarkable resurgence in job postings, climbing from a low of 35 in November 2024 to 666 in June 2025—a year-over-year increase of 240% from 196 openings in June 2024 (Figure 7). This hiring momentum aligns with Fiserv’s recent announcement of its own U.S. dollar-backed stablecoin, FIUSD, developed in partnership with PayPal and Circle.

Figure 7: Fiserv Job Openings

Ingram Micro: Strategic Restructuring and Growth

Ingram Micro’s job postings have also seen significant growth, rising from 96 in January 2025 to 487 in June 2025, marking a 408% increase from its yearly low and a 10% rise compared to 442 openings in June 2024 (Figure 8). This uptick follows a strategic restructuring earlier in the year, where the company reduced its workforce by approximately 850 associates to enhance operational efficiency and customer service capabilities. The subsequent increase in job postings suggests a renewed focus on growth and investment in key areas.

Figure 8: Ingram Micro Job Openings

Both companies are notable for rebounding after earlier slowdowns and show confidence through active hiring.

Looking Ahead

While the market remains cautious, there’s no shortage of movement. AI and financial services are charging ahead. States like New Jersey are reshaping transparency expectations. And remote work has found its post-pandemic equilibrium.

At Aspen Technology Labs, we’ll continue tracking these trends closely. In July, we’ll release our mid-year update with fresh insights on AI hiring, remote job shifts, and the summer workforce.

Michael Woodrow – President at Aspen Tech Labs, Inc. | Founder at Healthcare Data Analytics, Inc.

Catch up on our European Job Market Update in partnership with the Job Board Doctor.

[Want to get Job Board Doctor posts via email? Subscribe here.]

Comments (0)